Update on Subprime Auto Loans Delinquencies in the USA

It is still worth it to monitor closely the correlation between Short Term Interest Rates and the level of Delinquencies on the Subprime Auto Loans Business.

In the Chart below you can see that the 3 Months Interest Rate has reached levels not seen since 2009, i.e 1.92% which is roughly equivalent with the S&P 500 Dividend Yield.

The low interest rate regime that started during the year 2009 has supported a huge increase in Loan Originations on the Auto Sector. The increase of origination from 2008 until today has been staggering

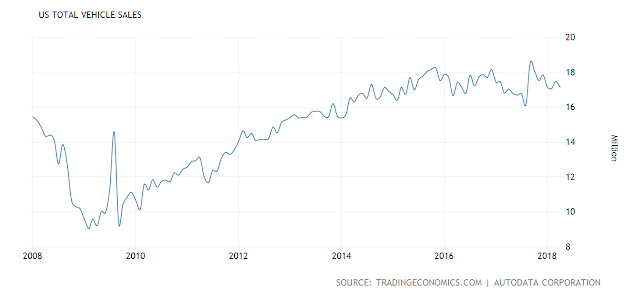

as a consequence new auto sales exploded.

At the same time, during the last years, something similar to the Mortgage Market 2008 Subprime Crisis happened to the car loan business. The Delinquencies over 60 days are higher now compared to 2008.

This is disturbing because Short Term Interest Rates have only reached around 2%. Why may have a problem if rates keep on rising. However, the problem should be more contained compared to the 2008 Mortgage Crisis because the Prime Credit Line is still stable and under control.

What is very interesting is that since the Fed reduce Quantitative Easing during the year 2015 the growth of Auto-Loan Debt has tanked and the new auto sales stabilized around 17M vehicles.

This may be an issue for OE Car Production. If Interest Rates will continue to grow and at the same time delinquencies will creep up, then the Auto Sales could go down pretty steeply during the next years

We have to continue to monitor this situation.

Comments

Post a Comment